Everyone’s talking about Artificial Intelligence (AI) and it’s implications. While many conversations revolve around where AI is going and what benefits and potential pitfalls could present themselves in the future, I’d like to talk about the here and now. Let’s start with the financial services industry, which has undergone a profound transformation, driven by the integration of AI technologies. AI is taking its place in every category of solution, helping enhance operational efficiency, revolutionizing customer experiences, offering the next level of Cybersecurity, and helping with decision-making processes. AI is a game-changer for banks, credit unions, investment firms, and other financial institutions.

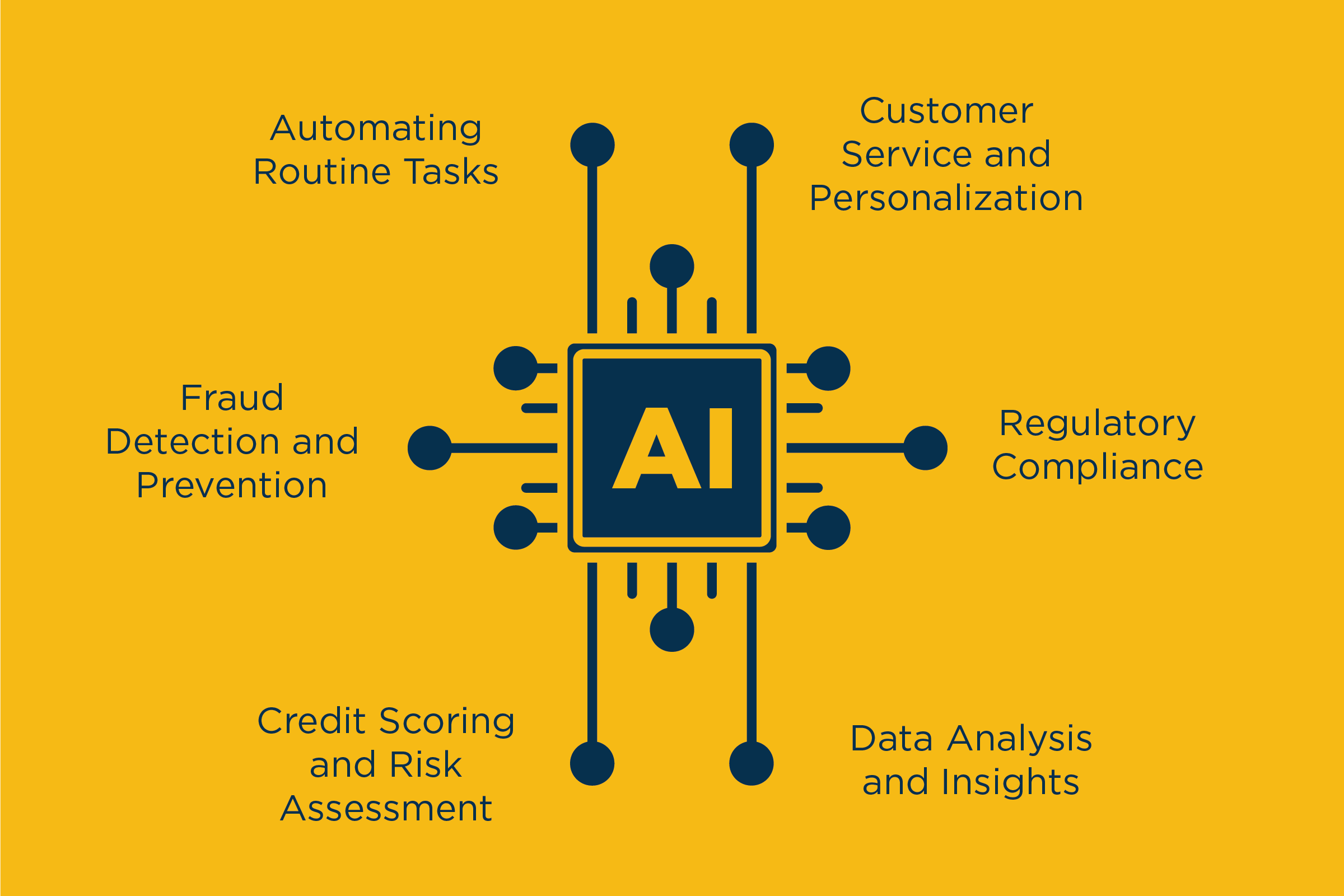

1. Automating Routine Tasks | AI streamlines many processes, allowing professionals to focus on more complex, strategic activities. Repetitive tasks such as data entry, transaction processing, and reconciliation can be performed swiftly and accurately by AI systems, reducing the risk of human error, and improving overall efficiency.

2. Fraud Detection and Prevention | One of the critical contributions of AI is in the realm of security. Advanced Machine Learning (ML) algorithms can analyze vast datasets to identify patterns indicative of fraudulent activities. Real-time monitoring and anomaly detection systems help financial institutions stay a step ahead of cyber threats, safeguarding client assets and organizational integrity.

3. Credit Scoring and Risk Assessment | AI allows the introduction of more data into the algorithms, including non-traditional sources such as social media behavior and online transactions, enabling more accurate and comprehensive credit risk assessments. This lets creditors make better-informed lending decisions and manage risk more effectively.

4. Customer Service and Personalization | AI-powered chatbots and virtual assistants have revolutionized customer interactions – for both employees and their clientele. Intelligent systems provide instant, personalized responses to customer queries, improving overall satisfaction and response times. AI can also give customer support team members more information, real-time feedback (guiding the conversation and even analyzing the mindset of the customer) and helps deliver a better ongoing relationship with the customer. AI-driven personalization allows financial institutions to tailor their services and product recommendations based on individual customer preferences and behaviors.

5. Algorithmic Trading | For investment and trading, AI-driven formulas are now indispensable, analyzing market trends, news, and historical data at speeds far beyond human capacity. By making split-second trading decisions, AI systems can optimize investment portfolios, manage risks, and capitalize on market opportunities in ways that were previously impossible.

6. Regulatory Compliance | The financial industry operates in a highly regulated environment and must adhere to compliance standards or risk fines and punitive actions. AI technology assists in automating time-consuming/time-sensitive compliance processes, ensuring the organization can keep up with ever-evolving regulatory requirements. This reduces the risk of regulatory breaches while minimizing the resource-intensive nature of compliance management.

7. Data Analysis and Insights | The sheer volume of data generated in the financial sector is immense. AI excels at extracting meaningful insights from this data. Machine Learning algorithms can analyze market trends, customer behaviors, and economic indicators, providing financial professionals with valuable information for strategic decision-making.

AI technology has and will continue to reshape how the financial services industry functions, introducing unprecedented levels of efficiency, security, and innovation. Organizations that embrace these advancements are better positioned to navigate the complexities of the modern financial landscape, deliver enhanced services to their clients, and remain at the forefront of a rapidly evolving industry. AI, like all the solutions in your technology stack, will continue to evolve, with its role expanding to unlock new possibilities and redefine the future of finance.

Want to learn more about AI, selling into any vertical, expanding what you offer across the IT stack, and the support you can receive from the Sales Engineering team? I support the Eastern region and Canada, you can reach out to me directly at [email protected]. You can also learn more about the team by visiting the Sales Engineering page or reach out to [email protected] and we’ll get right back to you!

To learn more about AI, selling into any vertical, expanding what you offer across the IT stack, and the support you can receive, the Sandler Partners Sales Engineering team hosted the “AI & the Impact to Your Customers’ Tech Approach” Tech Panel Webinar on September 10th and 11th! Over the two days we explored key areas including best approaches, benefits, and how to guide the conversation from start to conclusion. We also took a look at recent industry changes and how they’re impacting organizations you currently support and those you want to work with. On day 2 Dialpad, DYOPATH, For2Fi, and Pax8 presented their their solutions and where they work best! Missed it? Watch the recording today!

I support the Eastern region and Canada, you can reach out to me directly at [email protected]. You can also learn more about the team by visiting the Sales Engineering page or reach out to [email protected] and we’ll get right back to you!

Author:

Andrew Rustad

Andrew is the Director, Sales Engineer - East and is well respected and highly regarded. Andrew has an innate ability to assess critical business issues and deliver highly effective solution(s) that meet customer’s needs. With 20+ years of experience working with companies large and small, he’s an important Partner resource for growing business.